Some traders still think that a computer could not trade as well as they can.

-Thomas Peterffy (Founder of Interactive Brokers)

VerrilloTrading is proud to use Interactive Brokers (IBKR) to trade US Stocks and to manage long term investments. From what we have seen, there are limited options for reliable US stock brokers outside the USA. IBKR is a broker that is geared more toward experienced investors. Before discovering IBKR, here in Canada we were using Questrade and TD Direct Investing. Both of which offer a similar service but with higher trading fees, as well as account maintenance and inactivity fees. Switching to IBKR was an easy decision for us in 2019 as we were eager to improve our trading skills and knowledge. IBKR does have some challenges but overall they are a solid choice for investors outside the USA.

How we use the IBKR services:

- Trading US Stocks and Options.

- Managing long term accounts.

- Currency Conversion: IBKR currency conversions are done at the current spot rate with a low fee which ranges from $2 to $3 USD per order. What we noticed is that the commission stays this low even when converting larger amounts. This is the lowest we’ve ever seen for a currency conversion fee.

- Developing and expanding functionality through their various APIs which we try to keep in C++.

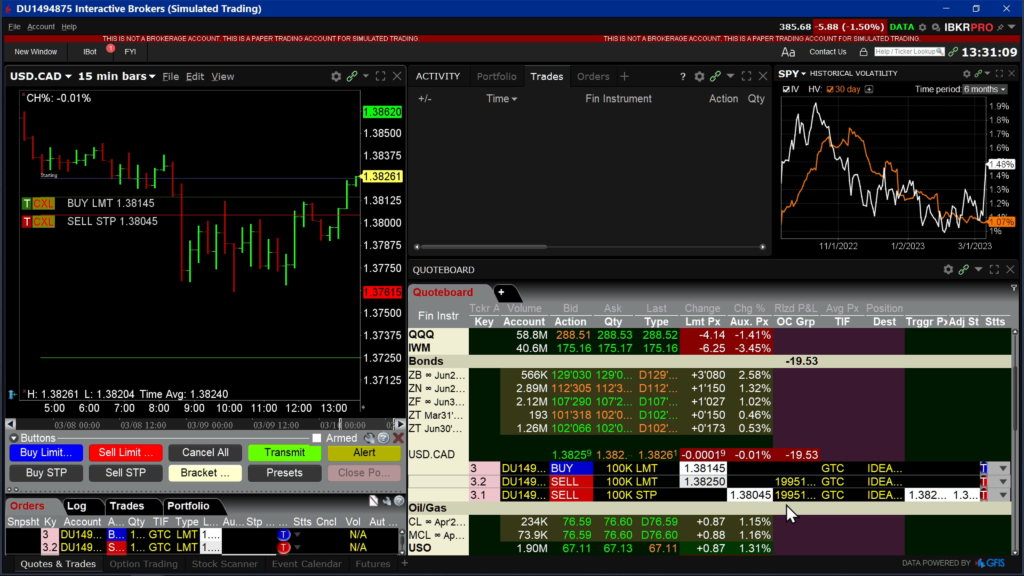

Trading with TWS

The Trader Workstation software by IBKR is a pretty decent program. It has a lot of advanced functionality that will serve the average trader or portfolio manager very well. TWS is not the fastest trading program, it runs in a Java based core. This makes it portable to various operating systems, but it falls a bit short in the performance department. There is an alternative for this which is IB Gateway. In our opinion, IBKR is a broker that is geared more toward portfolio management rather than day trading or another niche. They do have functionality that can be used for short term trading like their Advanced Market Scanner. Some of the features we use in TWS include the Portfolio Rebalance Tool, Quote Monitor, and advanced server-side order types like Limit-if-Touched Orders.

IBKR Mobile App

The IBKR mobile app is a highly advanced trading application right on your mobile device. At VerrilloTrading we use the IBKR Mobile App on iOS very frequently. The features we use most are the watchlists, and the market scanners which are able to provide real-time quotes of the most active markets. It also has a very handy economic calendar, as well as most of the client portal features. This app is full of hidden features and analytics and we would recommend it for serious investors. Check out this video to learn how to place alerts and convert currency directly from the app.

Trading with IBKR Client Portal

IBKR has done a lot of work to improve their Client Portal or Web-Based Account Interface. In regards to trading and order management, this is the platform we use the least. We use the Client Portal to set up deposit and withdrawal notifications for moving funds. We also use it to create and view account statements for Year-to-Date and custom time periods. The Client Portal also provides links to IBKR educational resources and a few portfolio management tools.

Features that make IBKR stand out:

- Low and transparent margin borrowing costs for trading US stocks. See full information on their Margin page. Interest is also credited for idle cash and they have a Lending Program for fully paid shares.

- Support for direct order routing to most ECNs, as well as SMART routing. Additional proprietary algorithms are provided to all customers to aid in order execution.

- Support for trading worldwide markets, view their Exchanges page.

- Low trading fees and zero account maintenance or inactivity fees. This page shows some comparisons to other brokers in Canada.

- Various methods of connecting programmatically, TWS API provides access to full options chain data.

The Cons about IBKR:

- No good for shorting hard to borrow stocks. They have a locate tool but it is only available to customers with a portfolio margin account. This account type may not be available in your country.

- The customer service is good but not great in some departments. We have had the best experience calling in rather than using online support. Try to be extremely clear with your questions.

- No incentives for small accounts, they cater more to larger customers. A few of the IBKR advantages exist for account balances upwards of 100k USD.

- High capital requirements for some products. Often no leverage is allowed on small cap and hard to borrow stocks. Futures contracts require the full exchange margin and sometimes even more.